NJ First-Time Homebuyer Grants

Buying a home is an important decision; however, some people feel they can’t afford it. Some home buyers have family members to get financial assistance from to help them buy their first house. But what if your family doesn’t have that kind of money, or what if they don’t own a home? Learning how the home-buying process works and where you can find the resources is most important. There are many programs to help, but what if you need financial assistance that you may not have to repay? No brainer, look into this one. This blog is about the NJ first-time homebuyer grant, which could get you up to $22,000.

NJHMFA First-Time Homebuyer Program

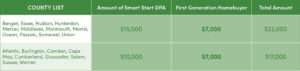

The NJHMFA down payment assistance program is for qualified first-time NJ homebuyers and provides the buyer with $10,000-$15,000 to use for their down payment and closing fees. The benefits of this loan are no monthly payments, no interest, and forgivable after five years, as long as you live in the house as your primary home. The loans would be fixed-rate 30-year, FHA, VA, USDA government-insured, or conventional loans through a participating lender. There are restrictions for this program, such as a maximum household income, but this loan is achievable for many first-time home buyers. Do you qualify to buy a house with only a 3.5% down payment?

First Generation Down Payment Assistance Program

In the first-generation down payment assistance program, you may qualify for a $7,000 grant in addition to the $15,000 NJHMFA first-time homebuyer program. You can get up to $7,000 if you are a qualifying first-generation first-time homebuyer grant. You will qualify if your parents or guardians do not own a home, even if they recently sold it. But don’t worry about your siblings beating you to this; they could also qualify for this grant. This is also forgivable on the $7,000 after five years as your primary home. Some restrictions apply; contact us to speak with a participating lender.

Conclusion

It takes a lot of work to buy your first home with real estate values as high as they are. But knowing that you can receive up to $22,000 Should push you to learn more. If you are considering purchasing your first home, you should look into this. This is a good program; many will qualify for up to $15,000, and some for an additional $7,000.

When we bought our first home in 1994, we received a $5,000 first-time homeowner grant. After five years, the grant was forgiven because the house was our primary residence. Considering the inflation in 1994 vs today, that $5,000 in 1994 is worth $10,384.24 today. With that said, these loan programs are a great deal and worth looking into. Don’t let this slip away; for a free consultation, contact us today.

Please contact us if you want more information and to speak with a participating lender.

Recent Posts

Navigating Probate: A Compassionate Guide for Those Grieving

Introduction In the wake of losing a loved one, grief can be overwhelming. Amidst the emotional turmoil, managing the complexities of probate can feel like an insurmountable challenge. Probate is...

The foreclosure process in New Jersey can be daunting for many homeowners. The lender considers specific steps before foreclosure. As a result, homeowners can find themselves in a difficult...